Masa Depan Ethereum Layer 2

Mengapa solusi scaling seperti Optimism dan Arbitrum adalah kunci adopsi massal blockchain di tahun 2025 ke atas.

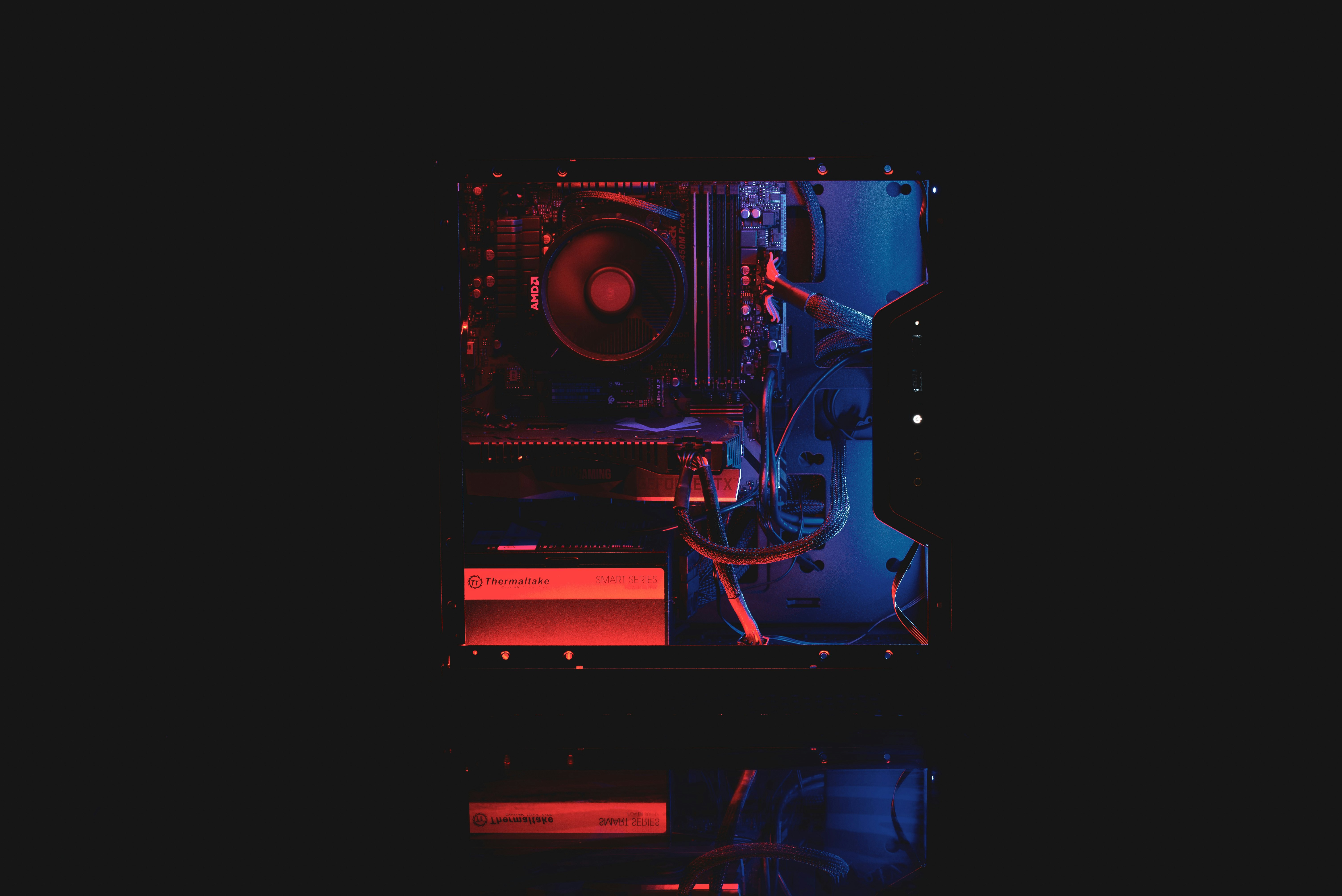

Baca Selengkapnya →Meninggalkan sistem lama yang tertutup. Aetheria Labs membangun protokol Blockchain, Smart Contracts, dan dApps yang transparan, aman, dan tanpa perantara untuk bisnis global.

Kami percaya bahwa kepercayaan tidak seharusnya diberikan kepada institusi, melainkan diverifikasi oleh kode. "Code is Law" adalah filosofi yang kami pegang teguh.

Sejak 2021, Aetheria Labs telah menjadi pionir dalam pengembangan solusi Layer-2 Ethereum dan infrastruktur DeFi (Decentralized Finance) di Asia Tenggara. Kami membantu korporasi bertransisi dari Web2 ke Web3 dengan mulus.

Teknologi blockchain end-to-end untuk skalabilitas tanpa batas.

Audit keamanan tingkat militer untuk kode Solidity dan Rust Anda. Kami memastikan kontrak pintar bebas dari bug, reentrancy attacks, dan celah logika sebelum diluncurkan ke mainnet.

Perancangan ekonomi token yang berkelanjutan. Dari staking mechanism, yield farming, hingga liquidity pools, kami membangun arsitektur finansial yang adil dan menguntungkan.

Bukan sekadar gambar JPEG. Kami mengembangkan utilitas NFT nyata untuk ticketing, sertifikasi digital, dan integrasi aset dalam dunia virtual (Metaverse) yang imersif.

Solusi Hyperledger Fabric atau Quorum untuk kebutuhan bisnis yang memerlukan privasi data namun tetap menginginkan integritas dan transparansi blockchain internal.

Sistem pelacakan logistik nasional berbasis blockchain untuk mencegah pemalsuan barang dan transparansi distribusi.

Decentralized Exchange (DEX) dengan fitur Automated Market Maker (AMM) pertama yang fokus pada aset kripto lokal Indonesia.

Prototipe sistem voting digital yang immutable dan verifiably secure, menghilangkan potensi kecurangan data suara.

Mengapa solusi scaling seperti Optimism dan Arbitrum adalah kunci adopsi massal blockchain di tahun 2025 ke atas.

Baca Selengkapnya →

Panduan lengkap bagi perusahaan startup crypto untuk mematuhi aturan Bappebti dan OJK terbaru.

Baca Selengkapnya →

Analisis teknis mengenai kerentanan yang sering terjadi saat memindahkan aset antar blockchain berbeda.

Baca Selengkapnya →Hubungi tim engineer kami untuk konsultasi awal. Kami akan membantu memetakan use-case blockchain yang paling relevan untuk bisnis Anda.

Jadwalkan KonsultasiSCBD District 8, Jakarta Selatan

hello@aetherialabs.io

@AetheriaSupport